Chief financial officers and controllers are often looking for solutions that will improve reporting accuracy, increase agility for future growth opportunities and streamline audits while supporting environmental, social and governance (ESG) initiatives. These solutions must overcome bottlenecks that prevent timely delivery of insights while centralizing activities using intelligent workflows guided by business rules. For SAP clients, integrating with the BlackLine solution optimizes a variety of accounting and financial operations, including risk and compliance management and service request efficiency improvement.

Integrating BlackLine with SAP offers significant business benefits, particularly for finance close teams. This integration ensures a seamless flow of information and transactions between the two systems, reducing manual data entry and reconciliation tasks, increasing process efficiency. It enhances data accuracy, minimizing the risk of financial misstatements and associated penalties. The integration also provides better visibility and governance over the financial close process, with a structured framework for managing intercompany transactions and reconciliations.

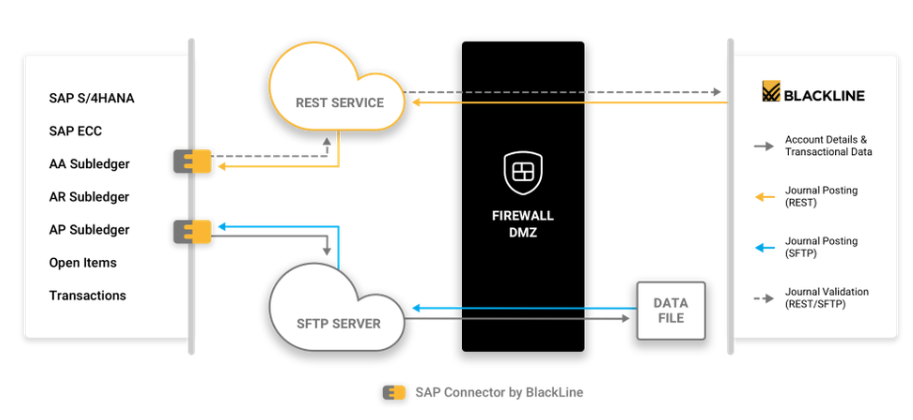

Source: BlackLine

Implementation approach

The SAP/BlackLine financial operations strategy aims to enhance efficiency through an overhaul of risk assessment methods and reconciliation approaches, updating policies and procedures globally with local considerations. To integrate SAP with BlackLine, begin by conducting a thorough assessment of current financial close processes and identifying areas for improvement. We suggest a collaborative effort with management to establish a task hierarchy aligned with corporate timelines and develop key performance metrics.

- Leveraging Protiviti’s proven methodology, ERP expertise and data connectors, a unified chart of accounts structure should be created to ensure system coherence.

- Utilize BlackLine’s pre-built connectors and SAP’s APIs to facilitate seamless data transfer and synchronization between the systems.

- Ensure robust data validation and reconciliation protocols are in place to maintain data integrity.

- Conduct comprehensive user training to familiarize the finance close team with the new integrated workflows and tools.

- SOPs should be revised based on this integration, with specialized training for a master user group on these new processes.

- Finally, perform rigorous testing in a controlled environment with comprehensive data validation through SIT/UAT to confirm the effectiveness of these changes before going live to ensure all processes function as expected, followed by continuous monitoring and optimization post-implementation to address any issues promptly and enhance system performance.

Client success story

In an era marked by digital transformation, a global education services provider client was grappling with outdated manual practices, including challenges in accounting accruals and data ingestion, heavily relying on Excel for journal entries. Protiviti recently supported this client with an approach that streamlined operations by classifying account risks based on trends and automating the integration between the client’s bank and ERP system, eliminating manual journal entries. We also facilitated automatic data ingestion and touchless account reconciliation through the automated integration of seven sub-ledger systems with BlackLine. This led to daily reconciliations instead of weekly, enhancing the timeliness of financial operations.

The transformation was significant; around 70 percent of accounts reconciliations utilized BlackLine’s standardized templates, reducing Excel reliance and improving visibility over month-end close. A collaborative workflow environment was fostered, lowering compliance risks. As a result, around 75 percent of reconciliations were auto-certified, an approximately 85 percent match-rate was achieved in matching AP subledger to bank transactions, leading to a successful transition from disjointed manual processes to an integrated efficient financial operation system.

This client realized several concrete improvements:

- Risk and compliance management: Integration with SAP GRC (Governance, Risk and Compliance) and BlackLine’s Account Substantiation created an efficient risk management environment.

- Data transfer automation: Secure pre-configured connectors provided seamless data transfer between the SAP environment and BlackLine’s cloud solutions, saving time over manual transfers.

- Financial close processes: The continuous accounting method enabled by this integration improved speed and governance while lowering risk and freeing up resources during busy month-end close periods.

- Automated postings and close operations: Automated specific postings and close operations within SAP environments.

- Service request efficiency: Time saved during service requests improved overall efficiency.

BlackLine complements the existing SAP software suite by providing an end-to-end solution for finance and accounting services, tackling conventional manual processes commonly performed outside of ERP systems, such as spreadsheets, opening the way for modernized finance operations.

Sivaram Chandrasekaran contributed to this blog post.

To learn more about BlackLine and our SAP consulting services, contact us.