Finance transformation is a top priority of most organizations. With recent disruptions caused by the COVID-19 pandemic, companies have struggled to scale their finance operations and find answers on major KPIs such as working capital and cash flow. These insights are key to addressing quick decision making to keep operations outpacing the ever-changing economic landscape. Historically, finance transformations have primarily focused on streamlining and optimizing processes, gaining efficiencies and productivity that merely relied upon the alignment of people, processes and technology. As a result, organizations have likely overlooked the risk, compliance, digital and analytical elements that are essential to any successful finance transformation.

Before embarking on a finance transformation, there are several considerations that must be incorporated:

- Establishing a successful vision

- Developing a transformation roadmap

- Defining success

Establish a Successful Vision

The finance transformation vision provides the basis for developing the transformation framework. The vision must be strategic and should take the organization’s overall growth strategy into consideration. To do this successfully, it must allow and account for people, process and technology alignment. All stakeholders should be aligned and participate in defining the vision for the future state transformation. Leadership plays a significant role in laying the foundation to evolve and balance traditional responsibilities with an increasing demand for data-driven analysis and insights that support growth and strategy. Additionally, the vision should include consideration of global competition, rapidly changing business and regulatory environments, and ever-increasing changes and innovations in technology and automation.

Change management is another critical element to drive the vision by effectively communicating with, and educating the organization on, the benefits of the transformation and why it is critical to achieve the desired future state. This helps facilitate a paradigm shift and focuses the organization while allowing people to feel empowered as they become advocates and drivers of transformation. This communication and change management needs to have a sense of urgency, come from the tone at the top, repeated often, and continually clarified to ensure it is properly enacted on by all parts of the organization.

Developing a Transformation Roadmap

The vision helps establish the foundation of the transformation roadmap, which includes the following elements:

Business Process Transformation

Process transformation is essential to achieve efficiency. Finance processes need to be analyzed end-to-end and enterprise wide as all operational processes downstream integrate with finance. Ideally, processes should be standardized, streamlined and optimized on a global scale. This allows complete enterprise-wide transparency and efficiencies. Process mining methods and tools should be used to identify relative waste, non-value adds and bottlenecks.

The global process needs to properly account for statutory and regulatory components. The only exception to the rule is localizations which represent local Generally Accepted Accounting Principles (GAAP) requirements and regulations such as treatment of depreciation in different countries, tax rules or other GAAP issues. At the same time, the process must extend flexibility and scalability to incorporate new accounting/GAAP standards and financial regulations. Centralize finance operations to ensure that the finance functions are valuable, efficient and cost effective. Many of our clients have achieved significant benefits through establishing a shared services model to centralize finance operations. Master data creation, analytics or operational reports, projects and assets can easily be centralized into Shared Services along with many other finance operations processes.

All processes must be supplemented by establishing governance to prevent a break in the process and for sustainability. For example, a master data creation and modification process should have an established governance process which incorporates effective controls.

System Transformation

The goal should be to simplify the IT landscape with applications and tools that are proven to support ERP technology and processes. For example, leveraging an ERP such as SAP S/4HANA helps to enable integration between upstream and downstream processes and utilizing a planning or analytics tool that integrates well with the S/4HANA landscape to exchange data without compromising integrity and controls. A well-designed application architecture improves efficiency both from a system and process perspective and enhances analytical capabilities. The system architecture must facilitate data exchange with governance and accuracy, to support strategic decision making. System transformation is also dependent on selecting the best platform to support the vision such as cloud, on-premise, single or multi-tenant solutions. Consideration of accessibility, optimized controls and automation help to guide the system strategy to define the right technology solution.

People Transformation

The finance and accounting functions must enable scalable growth, leverage leading technologies, transform the workforce from transactional to advisory and better integrate with other business functions. This requires thought leadership to change roles from traditional transactional processing to analyzing data and advising the business, allowing the workforce to focus on exception reporting, creating synergies and finding answers to help prevent anomalies from happening again. Finance transformation should reduce the time spent on traditional operations, giving internal teams more time to focus on analyzing real-time insights and exception reporting. Finance transformation should also focus on automating processes that are otherwise time or resource consuming, removing bottlenecks and streamlining the entering of transactional information in the system. Organizations should establish a continuous improvement mindset even after the finance transformation is complete. Systems like SAP S/4HANA can provide a foundation to enable artificial intelligence (AI) and machine learning (ML) to further enhance process automation.

Digital Transformation

There is an ever evolving and continuous need to engage digital platforms from automation to AI/ML as part of the overall finance transformation. These digital technologies can be used to automate repetitive processes and accelerate finance functions such as period-end close. Digital transformation can help to simplify the IT landscape and focus people on more tangible results.

Sustainability is the key to selecting or building the correct automation for a process. From applying Celonis process mining to determine the effectiveness of a process to leveraging Protiviti’s assure controls to assess automated controls and configurations, there are an abundance of digital tools available to accomplish digital transformation. SAP’s Suite of solutions (including S/4HANA’s native AI/ML and SAP iRPA) include several pre-built automations that facilitate rapid delivery of digital transformation goals. There are additional technologies that offer similar automation capabilities such as Automation Anywhere, UiPath and Blueprism, all of which fully support SAP solutions. It is recommended to only use automation tools that support or integrate well with the established ERP solution.

Defining Success

Define what success means before designing the solution. Critical drivers for defining success could be operational efficiencies such as shared services and centralized processes, process/IT landscape simplification, digital automation, new capabilities such as improved and real-time insights, etc. Additionally, align business requirements to success drivers such as:

- Streamlined process

- Predictive accounting

- Automated reconciliations

- Accelerated close

- Standardization and optimization

- Enhanced financial insights

- Reporting and advanced analytics

- Flexibility

- Scalability

- Data governance data quality

- Workflow automation and dynamic documentation

- Integration and reporting frameworks

- Controls optimization and automation

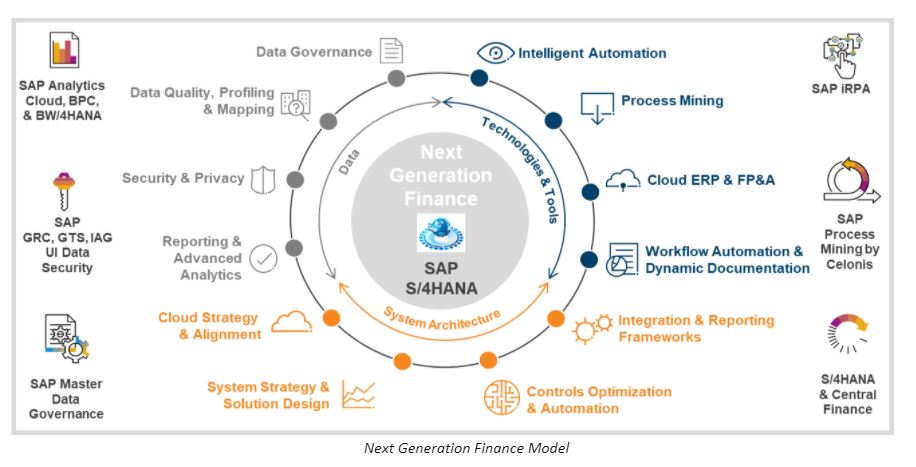

Solution Design provides a baseline to assess system strategies and capabilities against the operating model characteristics and business requirements. SAP S/4HANA and the associated ecosystem can play a pivotal role that helps to support and manage finance transformation and modernization across the business functions and deliver on the success drivers with new functionalities like universal journal, base and extension ledgers, new asset accounting and material ledger. SAP S/4HANA helps harness technology, system architecture and data and analytics to help establish a next-generation finance model. Utilize preferred IT solutions within the associated ecosystem to enhance transformation results such as Ariba to transform Source-to-Pay process or SAP Analytics Cloud to simplify consolidations process. National Vision is a good example of this as the company was facing inefficiencies in integrating its disparate systems and outside data sources. This, combined with complicated and slow calculations in their current financial environment, resulted in processing delays and difficulty updating existing calculations. The company needed to increase efficiency in its financial planning cycle and gain ease of collaboration.

To address these challenges, National Vision extended the capabilities of its SAP Business Planning and Consolidation software by adding SAP Analytics Cloud improving calculation performance by 100%, increasing reporting and planning accuracy by 60% and reducing planning cycle times by 20%.

As part of defining success, organizations should:

- Process mine to employ precise levels of workflow, automations and AI/ML capabilities

- Profile data for quality, application and derivation of analytics and reporting

- Build governance over static data for quality management and sustainability

- Establish, optimize and automate controls

- Enhance the solution by enabling strong security and privacy capabilities

Protiviti helps our clients develop and execute their strategies in all aspects of finance transformation including, but not limited to:

- Finance transformation assessment and business case development

- Future state design and optimization

- Project implementation strategy and roadmap development

- Data classification, protection and governance

- SAP solutions implementation

- Technology enablement

To learn more about our SAP and Intelligent Technologies capabilities, contact us or visit Protiviti’s SAP consulting services.