Surpassing Industry Challenges with SAP S/4HANA and Emerging Technologies Powered by SAP Leonardo

Even before the advent of the coronavirus pandemic earlier this year, the insurance industry was faced with some challenges that were proving difficult to overcome. Consumer expectations and behaviors are changing, as customers demand more self-service and hassle-free online insurance shopping options, driving traditional customer engagement models towards a more digital approach. Regulations continue to tighten as risk and privacy concerns rise. And the speed at which technology is changing is forcing the industry to move away from cumbersome, manually intensive data input tasks to leveraging large amounts of data into insightful information for decision makers. Across each of these challenges, competition from new market payers continues to strengthen as a result of digitization and the emergence of “insurtech” startups. SAP’s performance benchmarking clearly shows that companies that invest in new processes and technologies see measurable improvements.

SAP Performance Benchmarking

In our work with insurance industry clients, we often recommend SAP’s S/4HANA and SAP Leonardo solutions to form an enterprise digital core. SAP S/4HANA and SAP Leonardo give insurance companies an IT platform to achieve operational excellence and implement leading industry practices in every area of the business. These two solutions, when used in tandem, form a stable and reliable IT architecture that allows organizations to swiftly adapt to new challenges, opportunities and changes in regulation and business models. The S/4HANA in-memory computing platform is the foundation for incorporating emerging technologies from SAP Leonardo like machine learning, the Internet of Things (IoT), blockchain and predictive analytics. S/4HANA enables businesses to be nimble enough to adapt to the dynamic insurance environment, yet remain compliant with standards and regulations.

Changing Consumer Behaviors and Expectations

It often seems that consumer behaviors and expectations change with the wind, placing increased stressors on an industry that has historically been slow to embrace change. Among the issues we’ve seen are deficient sales capabilities as companies struggle to automate sales processes, lack of customer retention and loyalty as companies fail to provide an engaging, innovative customer experience and loss of potential first-time customers as millennials move to “born-digital” providers.

Implementing S/4HANA and Leonardo can ease these challenges in a variety of ways, including:

- Improved customer engagement through interactive experiences across multiple channels and self-service portals

- Seamless communications between people and devices, including integration of customer activities with IoT devices and sensors to track consumer behavior and develop intelligent policies

- Secure processing between businesses and networks leveraging blockchain technology

- Consistency in omnichannel marketing and consumer engagement efforts that foster customer loyalty and meet expectations of an increasingly discerning customer base

Tightening Regulations, Risk and Privacy Concerns

How do insurance companies today properly manage risk while remaining flexible in a dynamic regulatory environment? New regulatory requirements such as accounting standards for financial instruments and IFRS 17 accounting for insurance contracts, along with handling multiple GAAPs, make for nightmare efficiency scenarios. We often recommend S/4HANA and Leonardo to automate all compliance and risk management activities, including both asset-side (IFRS 9) management and accounting of financial instruments, as well as liability-side (I) management and accounting for insurance contracts. Other features include:

- The ability to manage multiple GAAPs in different ways, enabling easier year-end close processes

- Enterprise-wide visibility into financial, operational and actuarial processes through real time big data processing and predictive analytical capabilities

- Utilization of inherent protections built into SAP’s core product offerings, which helps organizations comply with new standards required by privacy regulations like GDPR and CCPA.

Rapid Technological Change

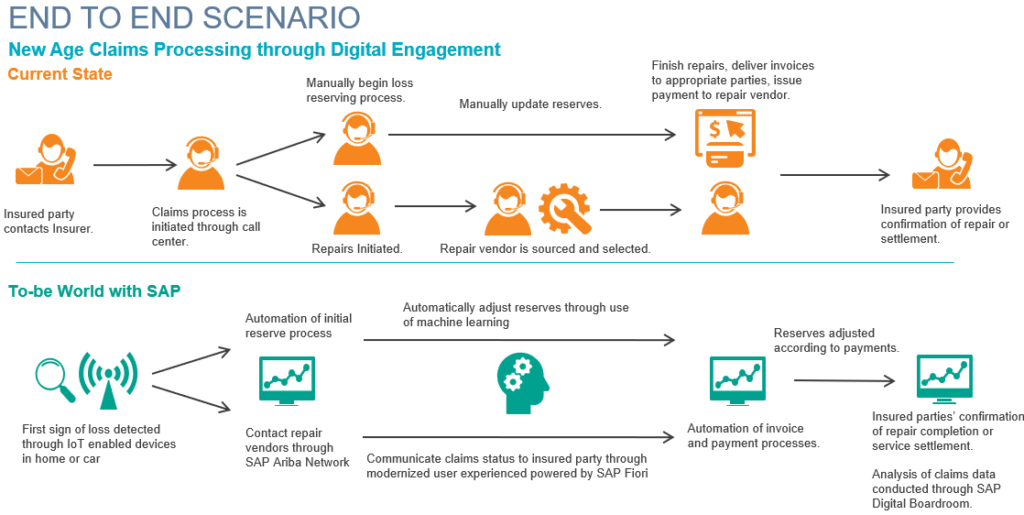

Many of the insurance technology leaders we work with grapple with how to best leverage emerging technology to transform their current business processes into digitally engaging customer experiences. In addition to changing expectations in the policy shopping and buying experience, once consumers are converted to policy holders, their expectations are also evolving around the claims processing experience. Moving from a cumbersome, often-delayed claims process requires seamless communications between customers, devices and insurers and fosters both digital engagement and policyholder satisfaction. Today, the insurance industry is turning to emerging technologies for:

- Proactive loss prevention through Internet of Things (IoT) connectedness of an insured car, home or personal wearable devices

- Expedited claims processing through smartphone-enabled reporting and timely repair service through the SAP Ariba Network of vendors

- Ease of claims processing providing opportunities to cross- and up-sell and an increase in customer retention

- Increased customer satisfaction through lowered costs and streamlined communication between the insured and the insurer.

Here’s just one example of a possible current-state to future-state scenario:

Be Proactive, Adapt Quickly and Avoid Industry Disruption

As a long-standing SAP Gold Partner, Protiviti offers a focused commitment to bringing our customers the latest in SAP S/4HANA, SAP HANA, Data Strategy, Analytics and GRC Solutions, enabling us to deliver unparalleled product strategy. For insurance companies, this means:

- Anticipating increasing demand for engaging customer experiences by fostering digital engagement through predictive analytics to match customer needs to tailored products and services

- Remaining compliant, yet nimble as an organization in the face of dynamic, tightening regulatory requirements and frameworks

- Enabling industry leadership through intelligent technologies as the insurance sector braces for disruption from born-digital market players and the emergency of insurtech

- Reinventing and digitalizing end-to-end processes in claims processing, protection services and product life cycles through connected devices, automation and machine learning

- Fortifying and ensuring operational excellence with improved intelligent processes powered by S/4HANA’s intelligent ERP system.

To learn more about our SAP and Intelligent Technologies capabilities, contact us or visit Protiviti’s SAP consulting services.