A Focus on Cost Effectiveness in a Time of Uncertainty

After a successful implementation of SAP S/4HANA® with Central Finance (CFIN), businesses can further extend innovations within CFIN to continue the journey towards the intelligent enterprise. As organizations look to drive more value from their SAP CFIN investments, enabling and improving shared services is a key step in unlocking the true value of CFIN.

SAP CFIN enables leaders to focus the business by evaluating the shared services function with a different business lens and perspective. Traditionally, shared services centers have existed to enable enterprises to manage homogenous processes in multiple source systems.  With CFIN, enterprises now have an opportunity to optimize their business processes using a single source system to achieve ROI on setting up a shared services center.

With CFIN, enterprises now have an opportunity to optimize their business processes using a single source system to achieve ROI on setting up a shared services center.

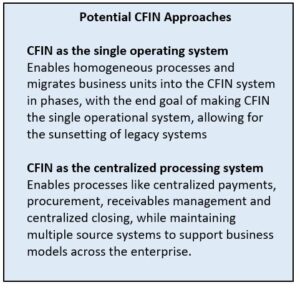

Whether leaving legacy systems intact and centralizing processing in SAP CFIN, or moving fully to SAP CFIN as a single operating system, the SAP CFIN capabilities discussed in this blog can help organizations achieve their shared services goals and desired outcomes.

Shared Services Optimization in CFIN

Central Finance enables businesses to standardize processes and procedures across all business units. In the past, businesses would establish regional shared services centers to centralize processes and ensure business units used similar processes to enable a faster close. Without a centralized ERP system, organizations were operating out of a centralized location, but functions were still specific to each business unit and its unique systems. This allowed for some optimization but fell far short of the efficiencies envisioned with a shared services model.

CFIN provides the foundation not only for centralizing resources, but also for establishing common processes and driving efficiency throughout the finance function. Regardless of the end state that a business pursues with its CFIN environment, significant efficiencies and improved services are achievable by leveraging capabilities such as Central Payment, Central Receivable Management, Centralized Close Processes and Financial Reporting.

For example, in a recent engagement our client wanted to establish SAP CFIN as a centralized system for reporting across ten business units. While this helped them report out of a single instance, their shared services center still had separate teams for each business unit operating out of the same office. This left significant CFIN value on the table. We engaged with the client to enable five business units to implement CFIN with centralized accounts payable, receivable management, indirect procurement and intercompany reconciliation. The business has now implemented central payments and receivables management and is continuing with plans to centralize the remaining functions. It has already achieved significant reductions in workload and is expecting further efficiencies and improved service as it continues to execute its plans.

Whether the strategy is to consolidate on SAP CFIN as a single operating system or to centralize processing of certain functions, the following areas are the key drivers for optimizing the value from an SAP CFIN investment.

Central Payment

Central Payment enables organizations to consolidate all open invoices and make payments from the CFIN system. This helps consolidate working capital cash requirements, commitment management and cash planning. Central Payment helps the business clear all open items centrally, without recording transactions to clear these in the local individual source systems. This capability provides companies with the ability to significantly improve cashflow and maintain a central view of commitments. If executed effectively, it also provides for efficiencies and reductions of resources required to execute these processes at the individual business unit level.

Central Receivable Management

Clients can centrally manage customer credits, collections and dispute management for all business units in the CFIN system. Central Receivable Management leverages the SAP System Landscape Transformation Server (SLT) to seamlessly integrate with backend SAP ECC systems and non-SAP ECC platforms

Regardless of the desired end state, the SAP CFIN Central Receivable Management functionality enables the credit team to assign and manage the credit data for all business partners centrally. This gives visibility to credit exposure and better reporting capabilities. One of our clients has enabled Central Receivable Management and has credit, dispute and collection activities done centrally from their regional shared service centers. This has helped improve overall cash collections, cashflow planning and management, while reducing days sales outstanding (DSO) and disputes.

Centralized Close Processes

Leveraging the shared services strategy, Central Finance enables accelerated period close processes. The functionality of “closing before the close” has gathered momentum where soft close and hard close are distinguishing features. Period close processes include comprehensive monitoring of the closing tasks through workflow, automated close activities, programs, jobs and remote tasks. Closing process activities impact enterprise wide functions from:

- Procure to Pay (PTP): managing goods receipt (GR), invoice receipt (IR) and purchase order (PO) processing for completing purchases

- Supply Chain Management (SCM): completing manufacturing operations, closing stock valuation and executing product cost runs

- Order to Cash (OTC): completing the billing and receivables management

- Record to Report (RTR): general ledger (GL) accruals, allocations, account matching and clearing activities

Whether the company consolidates into a single operating system or maintain integration to legacy systems, managing the close processes in CFIN helps to manage multiple legal entities in multiple source systems to optimize resource utilization with higher efficiency and automation for the entire close process. Where shared services are managed for geo-locations, CFIN is further enhanced through authorization controls to separate legal entities and activities managed across the shared services teams. An efficient workflow and email notification functionality enables task monitoring and handoffs where several teams are engaged globally in multiple shared services locations. Automated event triggers and central dashboard monitors minimize human error while managing period close activities across the enterprise.

Financial Reporting

In a major departure from earlier CFIN versions, it is now possible to perform profitability analysis in the universal journal, using criteria to analyze the operating results and to perform sales and profit planning. The replication of profitability analysis is integrated into existing message handling using SAP’s Application Interface Framework (AIF). The profitability analysis characteristics are mapped from source systems into CFIN for reporting. This enables extending profitability analysis components for the evaluation of market segments for a company’s revenue and profit. Reporting has been simplified to enhance user adoption and user experience using Fiori Apps for CFIN.

In uncertain economic times, focusing on innovation to drive cost effectiveness is important to every business. Extending innovations within CFIN is a good place to start. Streamlining shared services and leveraging functions such as Central Payment, Central Receivable Management, Centralized Close Processes and Finance Reporting elevates the value of a company’s CFIN investment. Overall, the enterprise objective for SAP CFIN and centralized shared services should be to move away from executing processes in multiple source systems to instead executing these processes in a single CFIN system, reducing the system learning curve, optimizing headcount and increasing efficiencies. As companies continue on the path to the intelligent enterprise, these strategies can help accelerate improved business performance.

For more information about Central Finance and SAP S/4HANA 1909, contact us or visit Protiviti’s SAP consulting services to learn more about our solutions.