Central Finance (CFIN) powered by SAP S/4HANA 1909 provides businesses with the ability to drive transformation beyond just a centralized reporting system. Central Finance is evolving from financial harmonization and consolidation to add additional tangible benefits for businesses including central payments, centralized receivable management, centralized procurement with Ariba and group reporting.

Central Finance 1909 Improvements and Changes

Group Reporting:

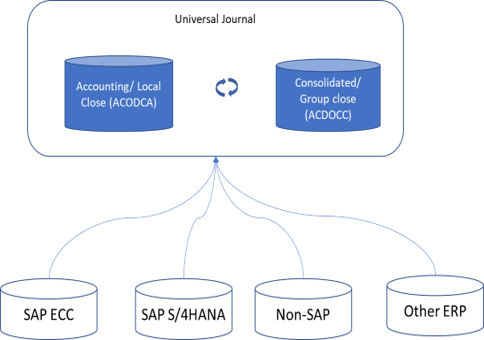

Group reporting is the solution for collection and consolidation activity to facilitate corporate/group close. Group reporting addresses consolidation of planned data and analysis, and consolidated group reporting. This solution uses data from the CFIN system to do consolidation at a corporate level, as well as intercompany elimination of payables/receivables. Several ERP systems can be combined with CFIN to bring data to the universal journal, which can then be replicated to the consolidation journal, where it will be leveraged for group reporting.

The new feature in 1909 for group reporting functionality helps customers more efficiently handle consolidations, intercompany reconciliation and netting and associated reporting and also helps eliminate the need for other consolidation tools/system.

Intercompany Reconciliation (ICR) Made Easy in CFIN 1909:

Central Finance (CFIN) supports certain processes that are typically done in centralized and consolidated processes. CFIN systems can help businesses with intercompany reconciliation (ICR) and provide increased efficiency, especially when there is a large volume of intercompany transactions between business units in different environments. Traditionally, business units do the reconciliation of intercompany transaction in their own system and would report back to corporate finance. With CFIN, once the transaction data is transferred to the CFIN system, ICR between open accounts payable and accounts receivable transactions across all business units is done centrally. Using the CFIN ICR, the businesses can also do intercompany eliminations. CFIN 1909 has enabled additional transaction replication using the SLT layer. This new functionality helps to streamline the intercompany reconciliation process and will help to increase both efficiency and accuracy of financial data through automation.

Central Payment in Central Finance 1909:

Central payment in Central Finance 1909 (CFIN) allows businesses to make payments centrally and perform centralized clearing in the CFIN system instead of at the source systems. Central payment was a challenge in previous versions because the open items, when replicated to CFIN system, were open in both the systems, which created the potential for inconsistencies. With 1809 and 1909 the source system open item, when replicated, gets cleared and the payment is executed out of the CFIN system. The central payment functionality can be activated by company code, and the invoices posted for those active company codes are cleared technically and replicated to the CFIN system. Once in CFIN, these replicated invoices are then processed and paid based on the defined payment terms.

A few key things to consider when evaluating this solution include:

- When a company code is activated – invoices in the source system are technically cleared, i.e, they are flagged with ALE-EXTERN, and the central payment document is not replicated back to the source system.

- During migration, the historical open items in the source systems, before switching to central payment, must be paid and cleared in the source systems.

- Paying centrally also requires VAT and withholding tax reports to be executed in the CFIN system. Note that there may also be restrictions on tax reporting.

Receivable Management in Central Finance:

Central receivable management automates, centralizes and simplifies the customer invoicing, receiving and cash management processes globally. Credit management in the CFIN system globally integrates and calculates the exposure from open sales orders from the local system and open accounts receivable items from the CFIN system of customer. Credit checks are triggered in the local system (during sales order entry or both order entry and delivery) and carried out in the CFIN system. Traditionally, the credit process was isolated and the global customer credit and exposure were not managed. With CFIN, customers can better understand their clients’ sales information to increase their bottom line.

CFIN enables and facilitates effective management of collections and disputes and provides better service to business partners (BP). This gives the customer the ability to centralize homogeneous processes into regional shared service centers, which helps customers better manage their credit, collection, dispute and cash management processes and reduce their DSO. Some customers have regional shared service centers but were not able harmonize the processes and still had to carry additional resources to support processes different systems. CFIN helps the customers realize the true savings for which shared service centers were established.

Cash and liquidity management can also be centralized and implemented in the CFIN system. The receivables and payable information are pulled in for liquidity forecasting. To get a global view, the corporate treasurer must consolidate the reports from subsidiaries. In CFIN, the global cash liquidity and forecasting is readily available for the corporate treasurer.

Financial Closing Cockpit:

SAP S/4HANA for advanced financial closing solution, the next-generation replacement for the SAP FCC, manages the entire end-to-end close process. This new functionality helps to automate and schedule processes, as well as track manual processes, to provide a comprehensive picture of the status of the close at any time (e.g., monthly, quarterly or year-end). It also embeds risk and compliance processes to improve overall closing capabilities.

Central Finance has come a long way in this latest 1909 release. Businesses have started implementing centralized processes like intercompany reconciliation (ICR), central payments, receivables management, central procurement powered by Ariba and the SAP financial closing cockpit (FCC). This provides businesses that have a shared services environment, or who are looking to implement one, with opportunities to improve efficiency and eliminate redundant processes while enabling finance modernization and transformation.

Visit Protiviti’s SAP consulting services page for more information on our solutions.